| |

| |

| ----------------------------- |

|

|

|

| |

| health |

| |

| PhilHealth

taking over OWWA Medicare |

| Last

Nov. 6, the Overseas Workers Welfare Administration (OWWA)

launched its outpatient clinic at the lobby of the Philippine

Overseas Employment Adminis-tration (POEA) building in

Mandaluyong City. The clinic, which is the second of its

kind, is OWWA’s way of enhancing its health care

services for OFWs and their dependents. It is also OWWA’s

pamasko for OFWs. |

OWWA

Deputy Administrator and Medicare Manager Delmer

R. Cruz, who led the launching ceremony, also disclosed

that the agency would open up similar clinics in

Cebu and Davao in January 2003. But sooner or later,

these clinics may no longer be under OWWA but under

the Philippine Health Insurance Corp. (PhilHealth),

a government corporation administering the government’s

medical care program for all Filipinos. PhilHealth

is taking over the function of providing health

and medical service to OFWs from OWWA by virtue

of its mandate. But OWWA wants to keep the function.

“We made a comparative

matrix of the package of benefits under PhilHealth

and OWWA Medicare.

|

|

|

| OWWA

Deputy Administrator and Medicare Manager Delmer

R. Cruz samples the service of Dr. Remy Magno-Tahil,

head of the OWWA outpatient clinic at the lobby

of the POEA headquarters. MedTech Elma Ligason and

RadTech Vic Jumarang look on. |

| |

|

The matrix

indicated that mas superior ang package of benefits and

services ng OWWA Medicare,” said Cruz, citing one

of the reasons OFW Medicare should be retained under OWWA.

Cruz cited other advantages of the OWWA Medicare.

Members of the OWWA Medicare and

their dependents may start availing of health and medical

benefits immediately after paying the P900 annual premium.

In contrast, availing PhilHealth

benefits is subject to a three-month waiting period. PhilHealth

members pay three regular monthly premiums of P100 within

six months prior to availment of benefits. The annual

premium in PhilHealth is P1,200 or P300 per quarter

OWWA Medicare also gives a 200%

increase in benefits for catastrophic cases such as injury

from accident and sickness.

Aside from superior benefits and services, Cruz noted

that with the presence of OWWA in countries where there

is a heavy concentration of OFWs, collection of membership

contributions and availments of medical benefits can be

done with dispatch. OWWA’s computer system, which

is already in place, facilitates the provision of Medicare

services to OFWs.

PhilHealth had invoked its mandate

under Republic Act 7875 or the National Health Insurance

Act of 1995 to justify its takeover of the OWWA Medicare.

RA 7875 provides for universal and compulsory health insurance

coverage of all Filipinos.

“Tama ‘yon, dapat

ma-cover lahat ng Pilipino. Pero di nangangahulugan na

isang entity lang ang magko-cover. Pwedeng ibang agency,”

Cruz said.

It is also OWWA’s position

that PhilHealth covers only indigent Filipinos or those

who cannot afford such health services.

Cruz added that RA 7875 has not expressly repealed Executive

Order 95, which creates the OWWA Medicare and authorizes

OWWA to collect, administer and disburse the funds of

its Medical Care Program for OFWs and their dependents.

In its position paper recommending

the retention by OWWA of the administration of the Medical

Care Program Fund for OFWs, the agency cited that RA 7875

and EO 95 are not inconsistent with each other and can

co-exist together.

OWWA added that RA 7875 did not

expressly provide for the transfer of the Medical Care

Program Fund for OFWs to PhilHealth.

For its part, PhilHealth promised OFWs and their dependents

that they will enjoy the same Medicare benefits as what

they are currently getting from OWWA after the transfer.

“Nananawagan kami sa mga

OFW na wala silang dapat ipangamba. Sisiguraduhin namin

sa PhilHealth na ang mga natatangagap nila sa OWWA ay

pareho din na matatanggap nila sa PhilHealth,” declared

Dr. Francisco T. Duque III, president and CEO of PhilHealth,

over the radio program Radyo OFW aired over DZMM every

Sunday.

“We will maintain the current

hospitalization and out-patient benefits that OFWs are

currently enjoying under OWWA, including the contribution

rate,” said Duque.

He also cited an advantage of

PhilHealth over OWWA Medicare.

“Ang lamang namin sa OWWA Medicare ay ang mga OFW

na naging member ng PhilHealth, pag naabot nila ang retirement

age, magiging lifetime member sila. Di na nila kailangang

magbayad pa pero tuloy-tuloy ang kanilang benepisyo,”

Duque told Radyo OFW host Rod Hizon.

Under PhilHealth rules, any OFWs

who retire at the age of 60 and have 120 monthly contributions

can qualify under PhilHealth’s Non-Paying Program

and enjoy Medicare benefits for life without having to

pay any contribution.

The earlier an OFW becomes a member

of PhilHealth, the more they are assured of qualifying

in the non-paying program, said Duque.

OFWs who eventually return for good in the country can

continue their Medicare coverage through PhilHealth’s

Individually Paying Program.

While it may not have offices

abroad, PhilHealth has 16 regional offices and 71 service

offices nationwide with 1,512 accredited hospitals, 289

rural health units and 17,555 doctors all over the Philippines.

As of September 30, 2002, PhilHealth

covers at least 40 million beneficiaries, six million

of whom are individual payees. Some 20 million are workers,

five million are indigents and almost 30,000 are non-paying

members.

Duque assured that PhilHealth

would properly main tain the P3 billion worth of Medicare

contributions of OFWs to OWWA.

“Maganda ang aming pamamalakad sa PhilHealth. Ang

President ng Pilipinas mismo ang nagsasabi na isa sa mga

top performing agencies ang PhilHealth sa taong ito. Maganda

ang aming ginagawa,” he said.

“Di namin papayagan na magamit ang pondo ng PhilHealth

sa iba. Hahanap pa tayo ng paraan para mas mapaganda ang

serbiosyo natin sa mga OFWs,” he added.

Congress wants to make sure that

the transfer of the OWWA Medicare to PhilHealth will be

for the best interest of OFWs. Sen. Loren Legarda Leviste,

the Senate Committee on Labor had set an inquiry on the

transfer after OWWA said such move would be detrimental

to the welfare of OFWs.

While the Senate may have a say

on the issue, an OWWA official believes that the President

can have her way by just signing an order. But if there

is anyone who must decide on this matter, it should be

the OFWs themselves because it is their money anyway.

|

| |

| Sound

fund

OWWA Medicare Manager

Delmer R. Cruz said that the OWWA Medicare finances

stand on very solid footing. “It can even

further enhance the Medicare package for OFWs,”

he said.

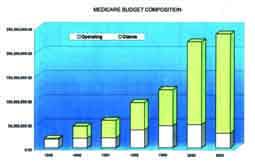

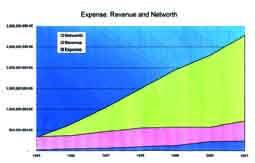

The fund’s projected

net worth by yearend of 2002 is approximately

P3 billion, proof that the money is in good hands

under OWWA.

The accumulated fund balance

within a span of only seven years was brought

about by the sustained high revenue generation

capacity of the system. Revenues generated by

the Medical Program increased from P339.87 million

in 1995 to P714.56 million in 2001 posting an

average annual increase of 18%.

The OWWA Medicare revenue

exhibited an increasing trend from 1995 to 1998,

remained relatively stable for the next two years

and bounced back in

|

|

|

|

|

|

| |

|

|

2001 attaining

the highest annual increase of 25.6 %. The total revenue

generated amounted to P3.57 billion in seven years or

average annual revenue of P509.89 million.

The collected premiums accounted

for 72% of rev enue while investment income contributed

28%.

The total expenses increased from

P19.85 million in 1995 to P261.01 million in 2001 or an

average annual expenditure of P117.17 million. About 70%

of the total expenses went to direct benefits and services

to members. This percentage accounted for only 23% of

the total revenue generated.

The efficiency of the OWWA Medicare

program operation is clearly shown by the small proportion

(7%) of the operating costs to revenue generated. |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|